Instilling Greater Responsibility Using the Palm Oil Resource Trade Cycle Model as Guide. A Commentary By Mallika Naguran.

Singapore 3 March 2014. Singapore is tackling the haze blame game by introducing a penalty card – fine or jail sentence for errant companies that have been found to be directly or indirectly responsible for the fires. The proposed Transboundary Air Pollution Act is intended to mitigate the year-after-year haze issue that enshrouds Singapore, causing immense healthcare, environmental and business related costs.

The Act, punitive in its object, fulfils only one end of the goal keeping. A game can only be played fairly and without dispute if there were clear governing rules in the first place. There exist no such game rules for agricultural-based companies profiteering from stripping forests bare or burning existing plantations to make way for new ones.

Forests are home to at least 70% of all land-based plants and animals, providing essential ecological services for human health, agricultural productivity and climate buffers. Forests help maintain soil fertility, protect watersheds and reduce the risk of natural disasters such as floods and landslides by regulating water supplies and reducing soil erosion.

Protecting such a valuable natural resource should thus be a requirement worked into the business regulations of agriculture-related companies registered in Singapore. Such companies, be they producers, traders or lenders, should demonstrate compliance to an international standard for sustainability with strict environmental protection.

Who’s to Blame

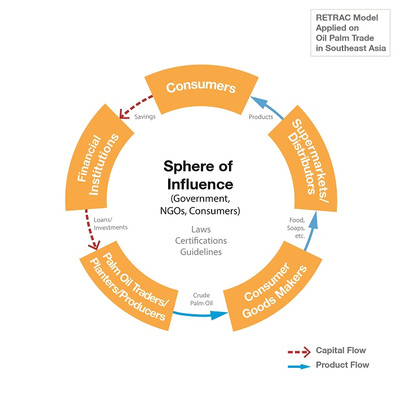

Regulating stricter ethics in capital flow would help in improving deforestation and plantation burning issues. Illustrated by Ivan Nasution.

Regulating stricter ethics in capital flow would help in improving deforestation and plantation burning issues. Illustrated by Ivan Nasution.Knowing what rules to apply can only come with the understanding of the kind of players involved and their relationship dynamics. A resource trade cycle analysis (RETRAC) model developed by Foundation Aidenvironment sheds light on this community and the linkages between the borderless demand, supply, production and consumption of natural resources based products. As haze has been attributed largely to the oil palm sector, a custom model helps identify capital and product flows (represented by arrows in the diagram), plus the policy leverage needed to manage sustainable oil palm trade.

Policy leverage is important arising from sustainability driving forces such as governmental laws, non-governmental organisation (NGO) activism, EU Renewable Energy Directive (palm oil in biofuel), and intergovernmental organisations e.g. International Finance Corporation. This sphere of influence towards sustainable palm oil production should be extended to key players involved in capital flows (e.g. bankers, investors, stock exchange) as they grease the product flow particularly between traders, plantation owners, palm oil producers and goods manufacturers.

Financial institutions, accountable for providing liquidity in upstream and downstream ventures of agricultural-based trade, can use their leverage to prevent deforestation and forest degradation. Banks can do this with strict engagement and investment policies for the agricultural sector (including forestry) and related trading companies, covering environmental impact, labour rights and human rights. WWF’s Palm Oil Financing Handbook is a good reference for fund, investment and credit risk managers.

Sustainability frameworks that are in place include FSC-certification for forest management and tree plantation operations; FSC Chain of Custody certification for entire wood product and processing chain; and Roundtable on Sustainable Palm Oil (RSPO) certification. However, RSPO, being a voluntary and non-binding scheme, has revealed loopholes and limitations, and as such must not be accepted as the ultimate green certification.

Clear regulations must exist on not siting investments in protected areas, High Carbon Stock Forests and areas with High Conservation Value. Along with that, respect the (land) rights of local communities and indigenous peoples is crucial.

Whatever certification is chosen, an initial independent assessment of socio-environmental impacts should be done to include the macro-impacts of new plantations located in regions in existing ones. The Singapore government could request for yearly compliance audit reports.

The sphere of influence causes ripple effects too. Incredible NGO activism had recently pressured Kelloggs to impose stricter requirements on its suppliers to protect forests and peatlands, and respect community rights. This chain of events has pressured Wilmar International, the world’s largest palm oil trader and an RSPO certified member, into tightening up its sustainability policies within its own supply chain as well e.g. oil palm planters and producers in Indonesia. The RETRAC model shows where and how else influence could be applied to put sustainability in action.

Sustainability in Action

A RETRAC study by Greenpeace in Netherlands in 1999 revealed that many plantation company clients of Dutch commercial banks were involved in social and environmental issues in Indonesia. The study also showed that financiers were able to influence their clients’ environmental policies but lacked internal policies to do so. Under NGO pressure in 2002, all Dutch banks signed a simple statement of intent to declare that no financial services would be made available to errant plantation companies that were involved in illegal activities, deforestation, open burning, or social conflicts.

A Friends of the Earth study in 2006, however, found that Dutch banks performed poorly in implementing such policies. Commercial banks then funded BankTrack, an independent NGO, to focus on banks’ compliance with the Equator Principles.

The Singapore government could likewise ensure the set up of a similar NGO, with the financial industry’s support, to enrich the resource database of agri-businesses’ documentation of licenses, land concession maps, supply chain partner lists, sustainability certifications and audits. Guided by RETRAC models based on agri-businesses, this funded NGO could also double up as the Singapore government’s watchdog to provide evidence for prosecution.

Strengthening the sphere of influence with laws is one aspect. It is by governing product and capital flows that can the agri-game be played well, that is, according to the rules.

Illustrated by Ivan Nasution.

An edited version of this article appeared in Today 3 March 2014. Here's the link to it.